why is actblue not tax deductible

Contributions or gifts to ActBlue are not deductible as charitable contributions for federal income tax purposes. Were a nonprofit for a few different reasons.

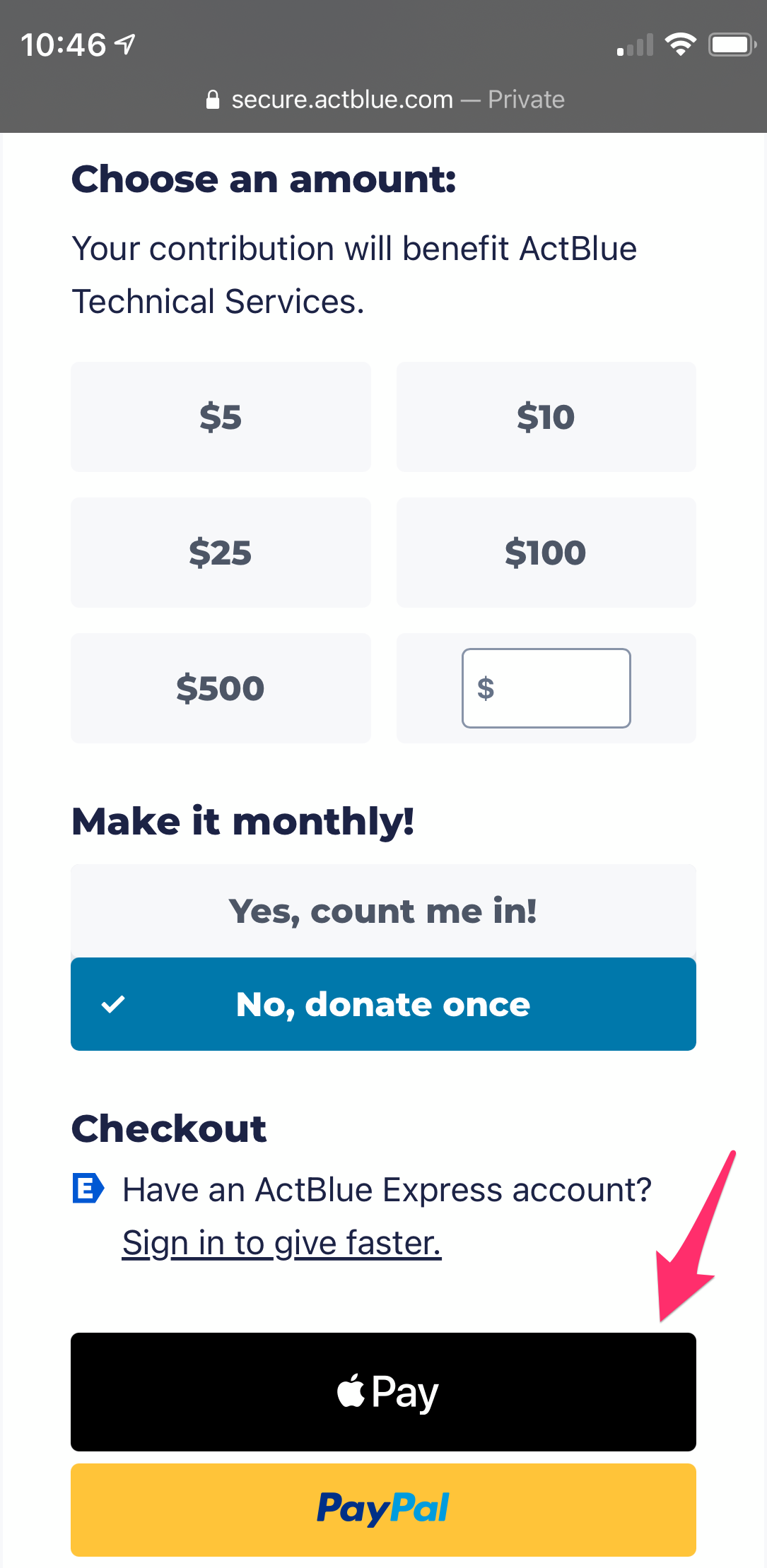

How Do I Use Apple Pay To Donate Actblue Support

About ten years ago I made two small one-time donations to two congressional candidates through ActBlue.

. Contributions or gifts to ActBlue are not deductible as charitable contributions for. Simply log in or create a new account with the. That mean paying out.

1 day agoBut the tax deduction case for Heard is considerably weaker. Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes.

Contributions or gifts to the DCCC are not tax deductible. Oct 19 2020 957 PM. ActBlue is a people-powered nonprofit.

Charity Navigator does not currently have the data required from e-filed IRS Forms 990 for Actblue Charities Inc. We provide our tools to campaigns and organizations at no cost. First we are a mission-driven organization.

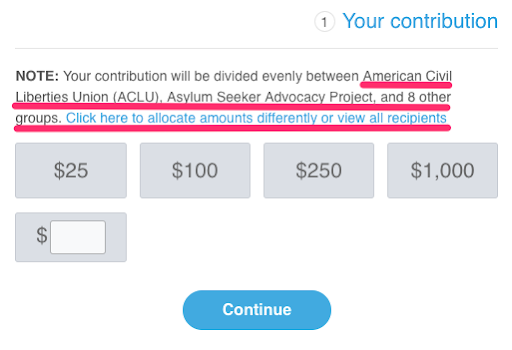

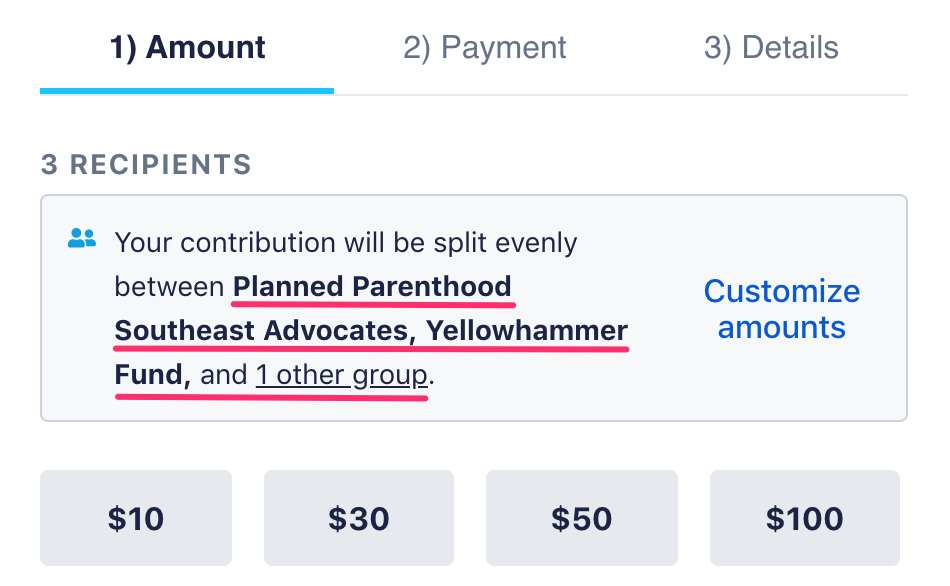

We do not fundraise or donate on behalf of anyone or choose candidates to support. Contributions are subject to the limitations and prohibitions of. Under the law contributions made through ActBlue are not considered PAC donations.

By proceeding with this transaction you agree to ActBlues terms conditions. At the bottom of the page it clearly states. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law.

The absence of a score does not indicate a positive or negative assessment it only indicates that we have not yet. Paid for by ActBlue Civics. They are not considered PAC donations.

I didnt check my credit card statement for several months but when I did I saw that not only had ActBlue turned my onetime payments into monthly donations but they had been paying themselves for administrative. Will you make a tax-deductible. Contributions or gifts to ActBlue are not deductible as charitable contributions for.

ActBlue is a pass-through organization and service for donations to left-of-center nonprofits and PACs. Likewise gifts and contributions to 501 c 4 social welfare organizations are not deductible as charitable contributions. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes.

Contributions or gifts to EMILYs List or endorsed candidates are not tax deductible. Because were a nonprofit our platform is powered entirely by the amazing small-dollar donors who invest in our work. Political donations to federal candidates and committees are not deductible from federal income taxes whether they are made online or in person.

However taxpayers who dont itemize deductions may take a charitable deduction of up to 300 for cash contributions made in 2020 to qualifying organizations. ActBlue is a United States political action committee established in June 2004 that enables anyone to raise money on the Internet for the Democratic Party candidates of their choice. This election cycle ActBlue has so far helped Democrats and progressive causes raise more than 1 billion a record said Caleb Cade a spokesman for ActBlue.

This cash donation will be classified as an above-the-line deduction when individual taxpayers file their taxes in 2021 reducing both AGI and taxable income. We envision a democracy where everyone looking to make. Thats why were working harder than ever to send out LGBTQ champions of equality like Ken Carlson to public office.

Donations to Everytown for Gun Safety Action Fund are not tax-deductible. May still be filing paper Forms 990. Contributions or gifts to NARAL Pro-Choice America a 501c4 organization are not tax-deductible as charitable contributions or as business.

As a service it charges a transaction fee of 395 for each donation it receives and passes. We process and send grassroots donations to the campaigns and organizations that use our. Under federal law these contributions are made by individuals.

Similarly left-wing advocacy groups such as Demand Justice fundraise through ActBlue Civics the 501c4 arm while Democratic PACs and campaigns. Donations to Everytown for Gun Safety Support Fund are deductible to the extent permitted by law. While ActBlue is organized as a political committee we act as a conduit for individual contributions made through our platform we do not make contributions ourselves.

ActBlue is organized as a political action committee but we serve as a conduit for individual contributions made through our platform. However donations to ActBlue Charities and other registered 501 c 3. If your donation is set up through ActBlue you can login to your ActBlue account and update your donation information.

This indicates that Actblue Charities Inc. Thats why were working harder than ever to send out LGBTQ champions of equality like Anthony Quezada to public office. It is independent of the Democratic Party itself and.

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. ActBlues mission is to build tech and infrastructure for Democratic campaigns progressive-aligned causes and people trying to make an impact in order to fuel long-term change. In her case this appears to be a personal dispute not about her trade or business.

Is actblue donation tax deductible. An individual can contribute as much as 36500 73000 per couple per calendar year to the DCCCs general fund for use at the DCCCs sole discretion. Contributions or gifts to ActBlue.

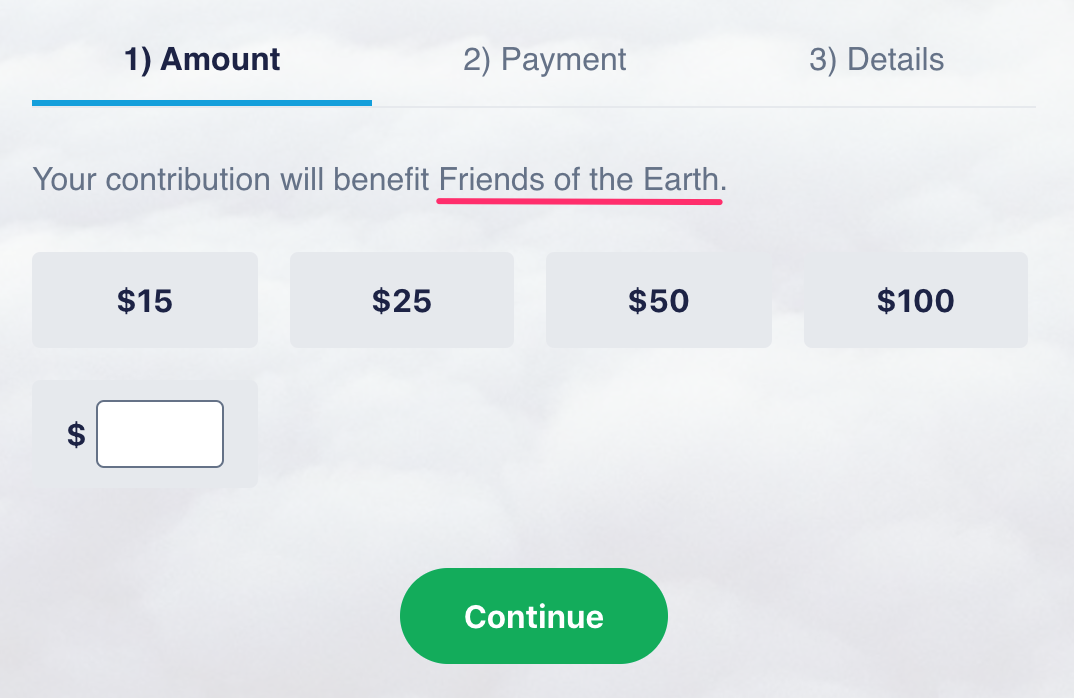

ActBlue Charities is not responsible for any political content on this page. ActBlue Charities is ActBlues funding platform built specifically for 501 c 3 organizations which can receive tax-deductible contributions. Theres just a 395 fee to process credit card contributions which we pass along to the groups that use our tools.

ActBlue Charities is not responsible for any political content on this page.

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

How Can I Look Up My Contribution Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

Are My Donations Tax Deductible Actblue Support

What Happens To My Money When I Donate Actblue Support

I Didn T Mean To Make A Recurring Donation What Do I Do Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

A Campaign Organization Sent Me A Link To Make My Own Fundraising Page What Do I Do Actblue Support

I Donated To A Charity Through A Secure Actblue Com Link Where Does That Money Go Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Why Don T I See My Donation History When I Log Into My Account Actblue Support

Are My Donations Tax Deductible Actblue Support

How Do I Know Who My Donation Is Going To Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

Creating An Actblue Express Account Using Google Actblue Support